Mingmei Xu

Professional Violinist

About

Mingmei Xu obtained her bachelor of violin performance at Beijing in 2011. After graduating with honors, she became a professional violinist in Beijing Philharmonic Chamber Orchestra (2011), Beijing Oriental Holiday Symphony Orchestra (2013) and Beijing Legato Chamber Orchestra (2013). At that time, she also worked as a specially-invited guest violin teacher at Gu AN Children Centre in Beijing, dedicated to furthering the popularity of violin art education. Many of her students have performed outstandingly in competition and gained admission as gifted students to the best primary and middle school in Beijing.

In 2015, she attended the MMus program at the University of Alberta, in Canada, where she was a master student under the supervision of Professor Guillaume Tardif. She also was involved as an orchestra and string assistant in Grandin Catholic School, Edmonton, combined with her string pedagogy course.

She used to be concertmaster of USO (University of Alberta Symphony Orchestra) . Now she is a member of ASO(Alberta Symphony Orchestra) violin player. And CSO (Concordia Symphony Orchestra) second violin principal.

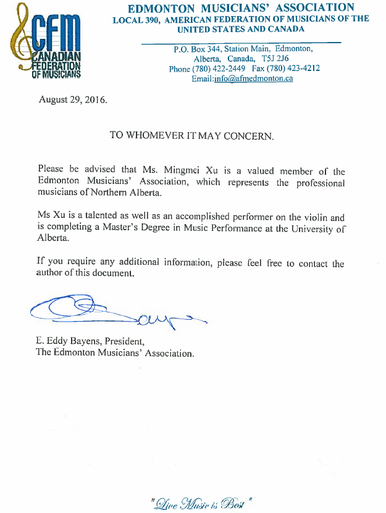

She also belongs to ARMTA (Alberta Registered Music Teachers' Association and CFM (Edmonton Musicians' Association under Canadian Federation of Musicians).

Get in touch!

EDUCATION

| University of Alberta, Edmonton, Canada | Master of Music Performance (Violin) | Sep 2015 – 2017 June |

| MinZu University, Beijing, China | Bachelor of Music Performance (Violin) | Sep 2007 – June 2011 |

Frequently asked questions

| 1. What do I teach ? |

| I teach violin in various levels from complete beginner to university conservatory entry level. The courses are designed for students to follow their interests. Different learning paths designed to fit each student's specialties. Also, students can choose RCM exams as their tool to measure their progress. Later on, students will be encouraged to participate chamber music and different youth symphony orchestras in local, such as EYO and NYO (Edmonton Youth Orchestra and National Youth Orchestra). |

| 2. What is the Children’s Art Tax Credit (CATC)? |

| For 2011 and subsequent years, the federal budget proposes a new non-refundable tax credit based on eligible expenses paid for the cost of registration or membership of your child in a prescribed program of artistic, cultural, recreational or developmental activity (eligible program). |

| 3. How much can I claim for each of my children? |

| The CATC will let you claim eligible expenses of up to $500 per year for each of your children who are: Under 16 years of age at the beginning of the year in which the expenses are paid; or Under 18 years of age at the beginning of the year in which the expenses are paid if the child is eligible for the disability tax credit. Also, if at least $100 in eligible expenses has been paid for a child eligible for the disability tax credit, an additional amount of $500 can be claimed for that child. |

| 4. How is the credit calculated? |

| The CATC is calculated by multiplying the lowest personal income tax rare (15% in 2011) by the eligible amount for each child. |

| 5. How will I claim the CATC? |

| Beginning with the 2011 personal income tax and benefit return, a new line will be incorporated into the Schedule 1, Federal Tax, to allow you to claim the credit. |

| 6. What programs are eligible for CATC? |

| To be eligible, a program must be supervised and suitable for children. Eligible programs include: |

| 1. A weekly program of a minimum eight consecutive week’s duration in which a minimum of 90% of all the activities are eligible activities; |

| 2. A program of a minimum five consecutive days duration in which more than 50% of the daily activities are eligible activities; |

| 3. A program that is part of a school curriculum will be ineligible. |

| 7. What are eligible activities? |

| Contributes to the environment of creative skills or expertise in artistic or cultural activities; |

| 8. What do creative skills or expertise in artistic or cultural activities involve? |

| Creative skills or expertise involve a child’s ability to improve dexterity or coordination, or acquire and apply knowledge in the pursuit of artistic or cultural activity. Artistic and cultural activities include literacy arts, visual arts, performing arts, music, media, languages, customs and heritage. |

| 9. What expenses are eligible for CATC? |

| Eligible expenses are fees paid for the cost of registration or membership, which includes the costs of administration, instruction, and the rental of facilities or equipment. |

| 10. I paid fees for my child to attend a program that involves both physical activity and artistic, cultural, recreational and development activities. Can I claim both CATC and the Children’s Fitness Tax Credit? |

| No. If the fees are considered an eligible expenses for the purposes of the Children’s Fitness Tax Credit, you will not be able to claim the CATC for these fees. |

| 11. How do I know if a program is eligible for the CATC? |

| Although the Canada Revenue Agency (CRC) will administer the CATC,organizations are in the best position to determine if the programs they offer are eligible. |

| 12. Should I ask for receipt? |

| You should receive, or ask for, a receipt from organizations that provide prescribed art programs for which you paid to have your child enrolled. The organization will determine the part of the fee that qualified for CATC. |

| Keep the receipts issued by the organizations that deliver the programs. Do not include the receipts when you file your income fax and benefit return. However, keep the receipts in case CRA asks for them to verify your claim. |

| 13. What does the CRA consider to be an acceptable receipt? |

| A receipt should contain the following information: |

| Organization’s name and address; |

| Name of the eligible program; |

| Amount received, date received, amount that is eligible for the CATC; |

| Full name of the payer; |

| Full name of the child, and the child’s year of birth; and Authorized signature. |

| Note: An authorized signature is not required for electronically generated receipts. |

| The above selected parts of the information on the Canada Revenue Agency website are provided to you by The Alberta Registered Music Teachers’ Association. A professional association of music teachers and a member of the Canadian Federation of Music Teachers’ Associations. |

| For more full text and further information, call Children’s Arts Tax Credit CRA General Inquiries 1-800-959-8281 |

| [http://www.cra-arc.gc.ca/gncy.bdgt/2011/qa01-eng.html ](http://www.cra-arc.gc.ca/gncy.bdgt/2011/qa01-eng.html ) |

Contact

12020-49 ave

Edmonton, AB T6H 5B5

587-938-3347

[email protected]